Strengthening Risk Management with Condition-Based Maintenance: How Power-MI Users Secure Better Insurance Contracts

For years, I’ve observed how some of our clients at Power-MI have leveraged Condition-Based Maintenance (CBM) to achieve outstanding operational benefits. One of the most surprising yet powerful outcomes is how these clients use Power-MI to demonstrate controlled risk and consistent reliability improvements to their insurance providers. Every year, I see more of our customers negotiating better contract conditions—lower premiums, fewer exclusions, and more favorable deductibles—simply by showing insurers the data-driven maintenance plans they have in place.

From my perspective as the CEO of Power-MI, this growing trend reveals a synergy between industrial insurance and maintenance. Insurers, once wary of the unpredictability in industrial environments, now find comfort in the factual evidence of risk mitigation that modern Condition-Based Maintenance provides. Companies that effectively harness CBM strategies are well-positioned to reap benefits: after all, proactive maintenance lowers the chances of unplanned downtime and catastrophic equipment failures—two costly risks that drive insurance rates up.

In this article, I want to share my firsthand experience in how businesses are using Power-MI to strengthen Condition-Based Maintenance programs. I’ll also discuss why insurers care about robust maintenance practices and how best to present evidence of risk reduction. I hope maintenance managers, plant managers, reliability engineers, and industrial engineers will find insights here on how data-driven maintenance can lead to advantageous insurance terms.

The Relation Between Condition-Based Maintenance and Risk Mitigation

Condition-Based Maintenance (CBM) relies on periodic monitoring of asset condition. Maintenance teams can anticipate equipment failures by monitoring machinery using vibration analysis, thermography, motor current tests, and ultrasound, among other techniques, and schedule corrective measures in a structured process. This shift from reactive or time- based approaches to ongoing, data-driven strategies significantly reduces risk in several ways:

- Fewer Catastrophic Failures: Detecting asset degradation early dramatically decreases the likelihood of sudden breakdowns.

- Reduced Secondary Damage: Spotting bearing or gearbox issues in time helps prevent serious damage to adjacent components.

- Improved Workplace Safety: Proactive interventions lower the risk of hazardous malfunctions, protecting personnel and surrounding equipment.

- Enhanced Production Reliability: Fewer unplanned outages ensure stable operations—a top priority for insurers focused on mitigating claim payouts.

Adopting Predictive Maintenance signals to insurers that a company is not leaving reliability to chance but instead employing a systematic approach to risk management. This evidence often translates into more favorable underwriting assessments and can reduce premium costs.

Insurance Companies and Their View of Risk

Understanding how insurers evaluate industrial risk is essential to appreciate why Condition- Based Maintenance holds such appeal. Insurers assess multiple data points, including accident history, industry benchmarks, safety track records, and maintenance protocols, to gauge potential exposure. Their primary concern centers on the probability and severity of claims. Large machinery breakdowns or operational failures in asset-intensive industries can lead to expensive repairs, extended downtime, and even collateral damage to property.

When underwriting an industrial policy, insurance companies typically consider:

- Historical Loss Data: Past incidents inform projections of future risk.

- Likelihood of Future Failure: Calculations around equipment reliability, operational conditions, and documented maintenance practices.

- Safety Standards and Compliance: Whether the facility aligns with recognized standards, such as ISO 55000 or ISO 13374.

- Preventive and Proactive Measures: Any substantive proof of risk mitigation efforts, including Condition-Based Maintenance and Root Cause Analysis initiatives.

In scenarios where insurers see thorough, data-driven maintenance programs, they can price policies more competitively or relax restrictive conditions. Conversely, companies lacking a robust maintenance strategy may face higher premiums or stringent policy clauses.

Demonstrating Lower Risk with Condition-Based Maintenance

Condition-Based Maintenance provides clear, auditable proof that a business proactively addresses operational risks. Since insurers fear unexpected losses, showcasing a strategy that detects and addresses faults early can substantially impact policy terms. Here are a few elements that maintenance leaders often highlight to insurance underwriters:

Condition-Based Maintenance provides clear, auditable proof that a business proactively addresses operational risks. Since insurers fear unexpected losses, showcasing a strategy that detects and addresses faults early can substantially impact policy terms. Here are a few elements that maintenance leaders often highlight to insurance underwriters:

- Data-Driven Insights: Sharing failure records, reports, and real-world diagnostic cases of failures can illustrate the predictive power of CBM.

- Adherence to Standards: Demonstrating compliance with recognized guidelines, such as ISO 55000 or ISO 13374, reaffirms that CBM is systematically implemented.

- Performance Metrics: Tracking Mean Time Between Failures (MTBF) and Mean Time to Repair (MTTR) offers quantifiable proof of reliability gains.

- External Validation: Certification from independent evaluators or success stories verified by an OEM can bolster credibility.

Armed with this information, maintenance managers can negotiate improved insurance terms. Many underwriters respond favorably to data showing a strong loss-prevention culture, allowing for lower premiums, broader coverage, or flexible deductibles. Some insurers may even waive time-based maintenance mandates if Condition-Based Maintenance is proven effective, further reducing costs.

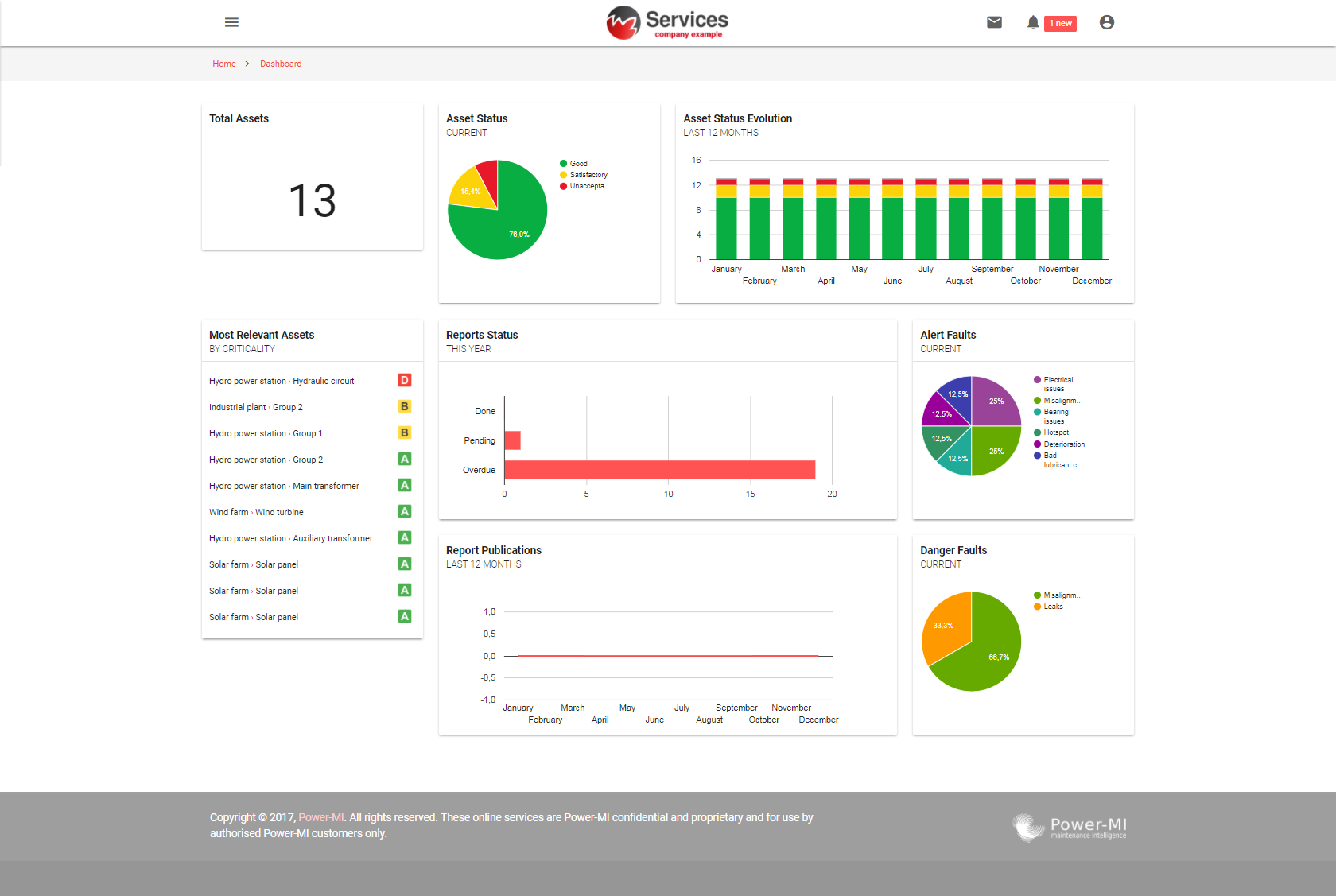

Ensuring Transparency with Software

Transparency is a pivotal factor in forging trust between companies and insurers. Our platform’s dashboards, analytics, and reporting tools enable teams to share maintenance data with underwriters or corporate risk managers without manual effort. This clear visibility fosters confidence in the accuracy and consistency of the Condition-Based Maintenance program.

Software Features that Enhance Transparency

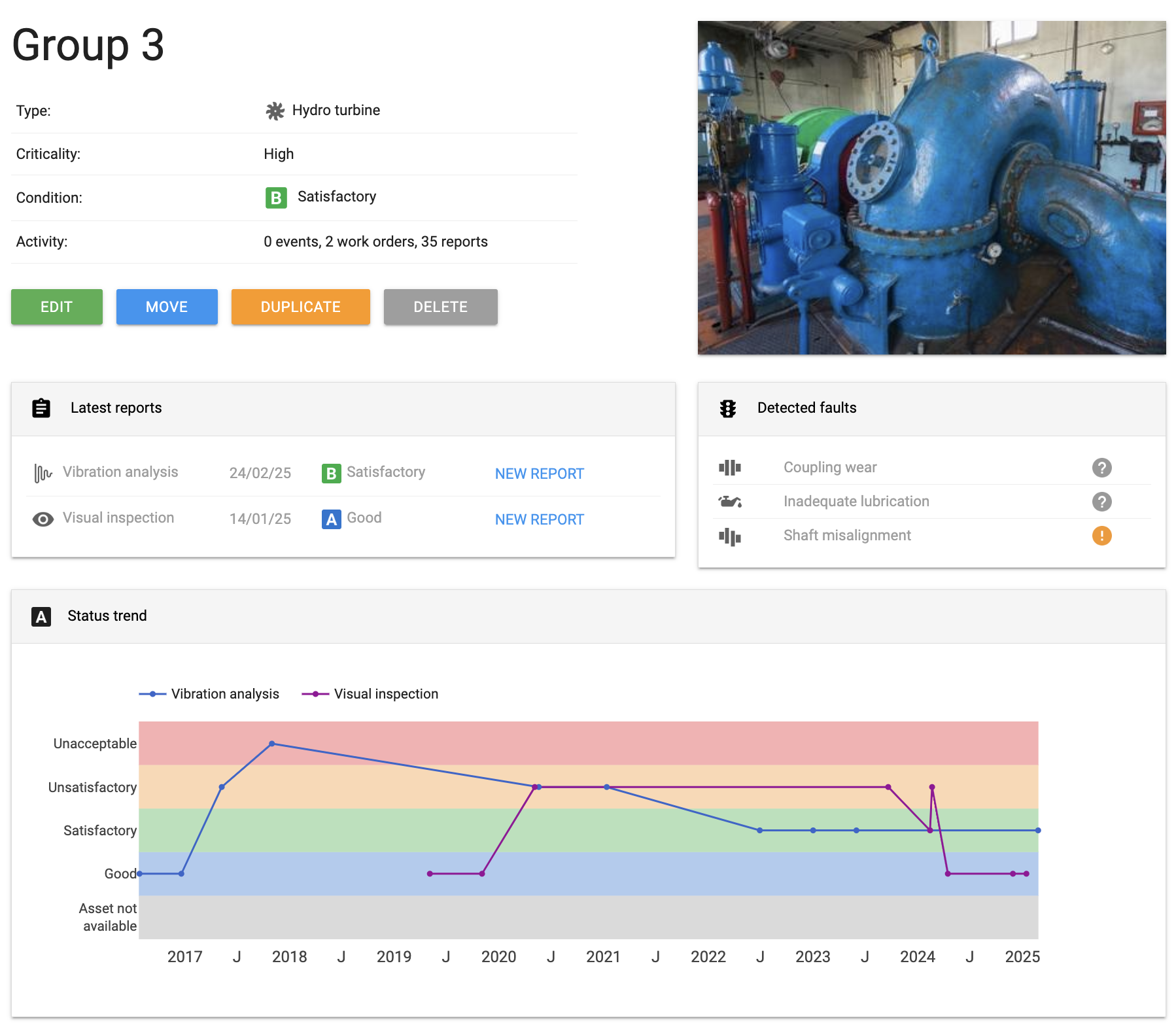

- Holistic Monitoring: A single platform to track all monitoring technologies, including visual inspections, ensuring comprehensive oversight of equipment condition.

- Reporting: Summaries of machine health, fault detections, and resolution timelines that can be readily presented to insurers.

- Historical Tracking: A comprehensive record of each asset’s reports, work orders, maintenance tasks, faults, and resolutions—plus failure statistics—offering a full timeline of how issues evolve, when they arise, and how they are resolved, all in one place.

- Enterprise Integration: By combining Power-MI data with ERP or EAM systems, organizations illustrate that CBM is woven into broader asset management strategies.

- Compliance Documentation: A robust document management approach woven into Condition-Based Maintenance processes, allowing full traceability of each procedure. It records who performed each action, why it was initiated, and how the solution was verified—ensuring every task aligns with best-practice guidelines.

Having a single repository for all this information eliminates the guesswork for insurers, making it simpler for them to see the program’s effectiveness. In cases of a potential or filed insurance claim, the historical record can clarify the chain of events and highlight the proactive steps taken.

Key Takeaways

- CBM as Core Evidence of Risk Management

Detailed and data-supported Condition-Based Maintenance strategies show insurers that you’re effectively mitigating equipment failures. - Trust Through Transparency

Leveraging platforms like Power-MI to openly share maintenance data removes doubt, increasing insurer confidence in your operations. - Negotiation Leverage

Insurance providers routinely reward a proven CBM program with better premiums or more favorable contract conditions. - Stronger Maintenance Culture

A well-structured, proactive maintenance environment highlights a company’s commitment to risk management, an essential factor in insurance underwriting. - Continuous Collaboration

Ongoing communication with insurers—supported by reliable data—strengthens relationships and helps ensure that your maintenance successes translate into tangible policy benefits.

Conclusion: The Power-MI Advantage

At Power-MI, we believe Condition-Based Maintenance (CBM) is more than just a best practice—it's a competitive advantage. A robust, data-driven CBM strategy not only boosts reliability and operational efficiency, but also strengthens your standing when negotiating insurance coverage. By tracking key performance metrics and showing clear evidence of risk mitigation, you demonstrate to insurers that your company is prepared for potential failures and actively working to prevent them.

With Power-MI, you can consolidate and visualize all asset health data, create detailed reports for underwriters, and provide transparent, verifiable proof of your proactive maintenance culture. This streamlined view of equipment performance helps you identify issues early while giving insurers the confidence that your organization is serious about preventing unplanned downtime and costly claims.

The Power-MI Edge

- Unified Dashboard: Integrate all monitoring techniques—vibration, thermography, ultrasound, and more—into a single, user-friendly interface.

- Timely Alerts: Identify anomalies and deviations promptly, enabling maintenance actions that demonstrate proactive risk control to insurers.

- Clear Documentation: Provide insurers with succinct, evidence-based records of your maintenance interventions, reinforcing your risk-reduction strategy.

- Customized Analytics: Tailor your reporting to highlight the KPIs insurers care about most, such as MTBF or failure rate trends.

- Collaborative Platform: Invite stakeholders and underwriters to view select data, making your insurance negotiations more transparent and productive.

By leveraging these benefits, you transform CBM into a critical pillar of your broader risk management strategy—one that insurers reward with improved policy terms.

References

- Industrial IoT Analytics, accessed on January 24, 2025.

- Power-MI: Visual Condition Monitoring Platform, accessed on January 24, 2025.

- Power-MI Field Implementation Guide, accessed on January 24, 2025.

- ISO 55000 Asset Management Standard, International Organization for Standardization.

- ISO 13374 Condition Monitoring Standard, International Organization for Standardization.

What is Power-MI?

Power-MI is a cloud based solution that allows you to design & manage your condition-based maintenance plan integrating all techniques into one platform. Easy reporting, automatic work orders and CMMS integration.

Read more